Rising interest rates splashes market with some chill

After months and months of overheated activity with demand far outstripping supply, the Denver real estate market experienced a dose of chill recently as mortgage interest rates have begun to creep up past the 5 percent threshold.

The March data from the Denver Metro Association of Realtors — the latest available — does not completely reflect this trend as March activity reflects more the conditions at the beginning of the year.

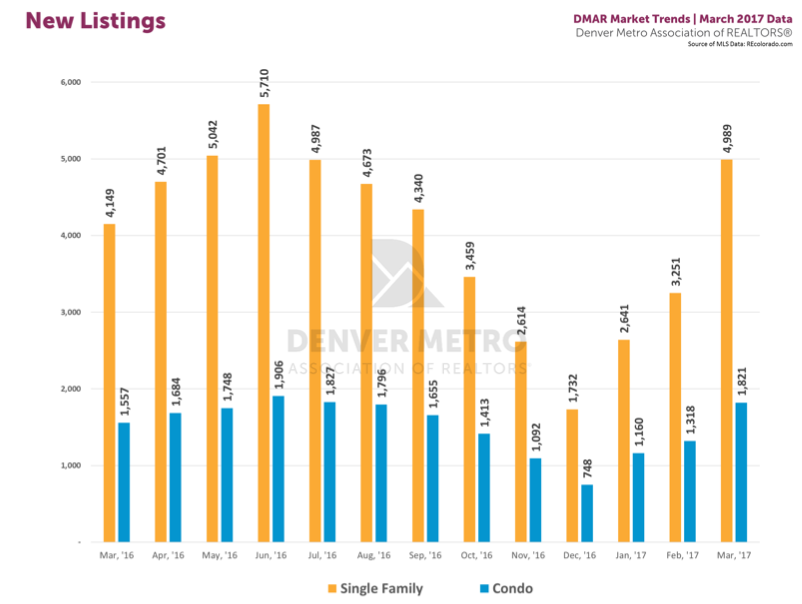

March, which typically kicks off the Denver area’s selling season, however, saw a large jump in single-family Denver metro home inventory, up 29.3 percent from February (which had recorded an all-time low).

Source: DMAR

Despite the data not completely showing it yet, the market has definitely changed. The increase in interest rates is impacting the market. It is real.

I’m seeing sellers drop their price, fewer homes fetching multiple offers, and more buyers expressing price discipline. For example, our listing, 2201 Eudora Street in Denver’s City Park neighborhood, which just sold for $1.8 million, had some very interested buyers who didn’t offer because it was at the top of their price range.

Want help navigating on the changing Denver neighborhood real estate market? Email me at kharris@milehimodern.com

What this means for sellers and buyers

While the market may be shifting, I’m advising sellers with homes not receiving the attention they expected to consider holding their price and giving the market a little more time. Buyers are still out there.

Also, I’ve heard from my mortgage connections about a strategy some sellers are pursuing — instead of lowering the sales price, they’re offering to pay down points on buyers’ mortgage rate, which gives them a lower monthly rate, helping buyers meet the sales price with more buying power.

Stubborn listing hanging out there. 60% of homes go under contract in the first weekend. If it’s hanging out. Rather than doing a price reduction. Offering the buyers to offer to buy down the interest rate.

For buyers, find a lender who can work with you to get an aggressive rate or consider adjustable rate mortgages (ARMs), which have lower rates, but which can change after a holding period, typically the first decade of the loan.

Buyers typically don’t like ARMs, because of their variable nature, but while the market still has low inventory, it’s a way buyers can compete for limited homes. Also, many buyers refinance their mortgages, which can happen before the ARM kicks in.

Also, as mortgage rates creep up, cash buyers become even more valuable, but that domain remains relatively exclusive, though not uncommon.