Market shifts requires adjusting to a new real estate reality

The Federal Reserve raising rates is having impacts throughout the economy, not just on mortgage rates, both of which are having big impacts on Denver’s real estate market.

As the economy sputters and interest rates have crept past 6 percent, the market has definitely slowed. But that doesn’t mean it has stopped, of course. Denver real estate, especially in my core market of central Denver neighborhoods, is still seeing a high demand.

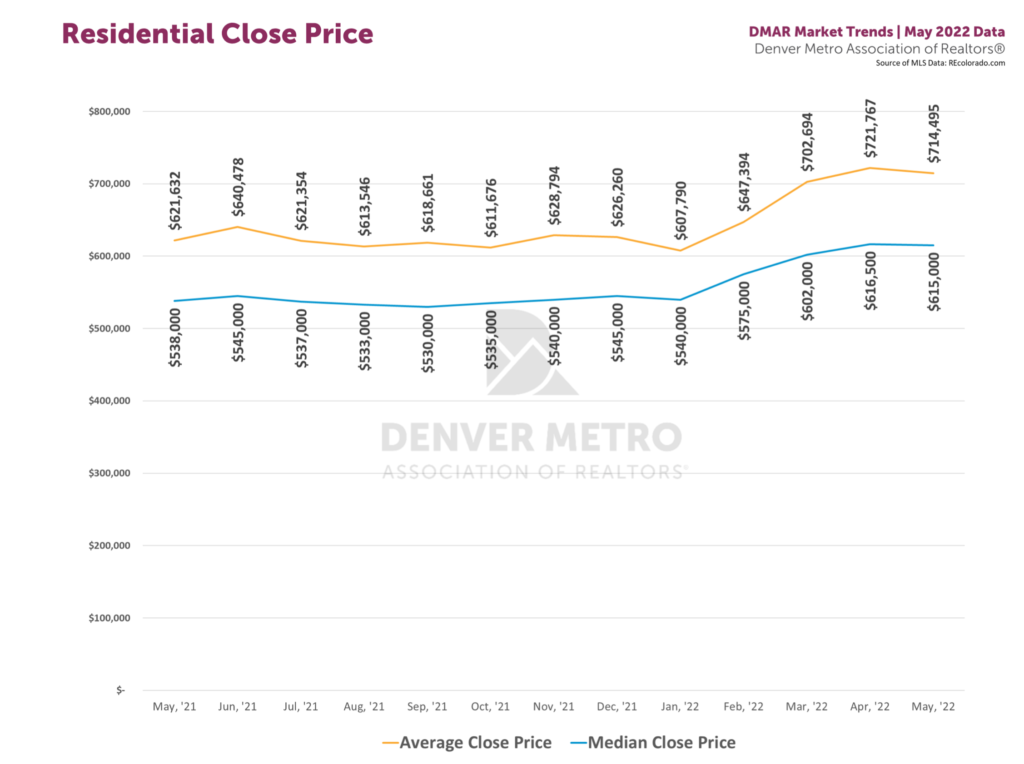

For example, Denver metro single-family homes saw 2.4 percent less sales in May from a year ago, but the price of closed homes still averaged 5.3 percent over the list price. This exemplifies the continuing market demand, marked by the average metro home close price of $714,495 in May.

Source: Denver Metro Association of Realtors June Market Report

While the average list-to-close price is still high, it dropped 1.7 percent in May from April and 0.6 percent from a year ago. I’m seeing this play out on the ground, too.

The numbers of offer each house is getting are dropping and as well as the amount of over-list offers. Also, we are seeing an increased number of price reductions in June. For example, 9.7 percent of closed transactions in May included a listing that reduced its price, that’s up 3.1 percent from April and 3.0 percent from a year ago, according to MLS data analyzed by First American Title rep Megan Aller.

Want help navigating on the changing Denver neighborhood real estate market? Email me at kharris@milehimodern.com

What this means for real estate consumers

This shifting market means, homebuyers and sellers need to tune into the market. The bottom is clearly not falling out of the market, but we are no longer as far into a sellers market as we have been over the last several years.

But sellers, in my opinion, still have the upper hand in the market, with inventory still measuring less than a month (six months of inventory represents a balanced market).

In this market, sellers will have to pay closer attention to pricing their homes correctly. Buyers are clearly more value-driven now; they were desperate up until about March, but no longer. This means doing real-time market analysis by your agent and providing a clear-eyed price.

For buyers, this market offers great opportunities to get under contract. They’re facing less competition and a little more leverage in negotiations with sellers.